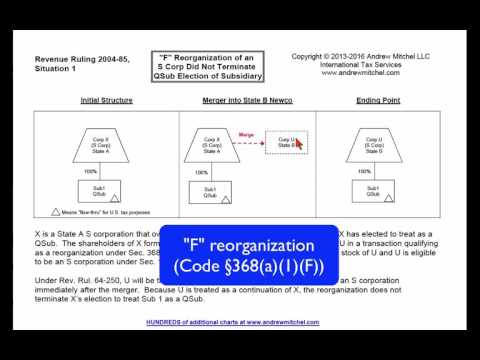

In revenue ruling 2004-85, Situation 1 Corp Ex, an S corporation was formed in State A. This S corporation was a wholly-owned subsidiary of Subway Corporation, which was elected to be treated as a qualified subchapter S subsidiary (also known as a Q sub). - Corp X, the S corporation, desired to reincorporate in State B. In order to achieve this, the shareholders of X formed a new State B Corporation called Corp You. X then merged into Corp You. - The ruling concluded that the merger of X into You constituted an F reorganization. An F reorganization involves a mere change in identity, form, or place of organization of a corporation. As You was seen as a continuation of X, it was treated as an S corporation without needing to undergo a new S election. - Additionally, since You was considered a continuation of X, the F reorganization did not terminate the Q sub election for Sub 1. This meant there was no requirement to make a new Q sub election for Sub 1.

Award-winning PDF software

F reorganization statement tax return Form: What You Should Know

B) — What is an F-reorganization? 26 CFR § 1.368-5(b) — What is an F-reorganization? The terms “form or change in form of a taxpayer” and “organization” are used interchangeably when discussing “corporate reorganizations.” 26 CFR § 1.368-3 — records to be kept and information to be filed with returns. (a) Parties to the reorganization. The plan of reorganization must be adopted by each of the owner What is an F-Reorganization? | Dallas Business Lawyer For Tax Purposes, a “corporate reorganization” is the process by which a single corporation or limited liability company transforms itself into a new type of corporation or a new type of limited liability company: a “franchisee” or “partner” corporation or S corporation. If a “corporate reorganization” does take place, then the purpose of such a change in ownership is generally for tax purposes; that is, to reorganize the corporation to meet tax obligations. The terms “corporation,” “limited liability company,” “partnership,” or “cancelled partnership” are used interchangeably with corporate and partnership terms. The following are some of the steps that must be taken to initiate a corporate reorganization: The owners of Target Company form NYS Corporation New Co. form New Co Inc (corporation) Incorporate the company at the current address of its principal executive offices, or a branch facility of the corporation, as established under 26 CFR § 1.501 — Form of New Co, Inc. Incorporate the members of the partnership, as follows. Acquire a second corporation (the “cancel” corporation) from the primary owner of both corporations (the “cancel “cor pony”). Acquire a member corporation from the primary owner of that corporation (the “acquire,” or “cancel,” “cor pony”). After both organizations are created, the members of the two organizations must meet the requirements necessary for their tax reporting on their income tax returns. For tax purposes, it is important to note that the business entities created in the above process will not change their corporate name, because their name (both for tax purposes and in their individual tax returns) will remain the same, either unchanged or as changed by incorporation.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8869, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8869 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8869 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8869 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing F reorganization statement tax return