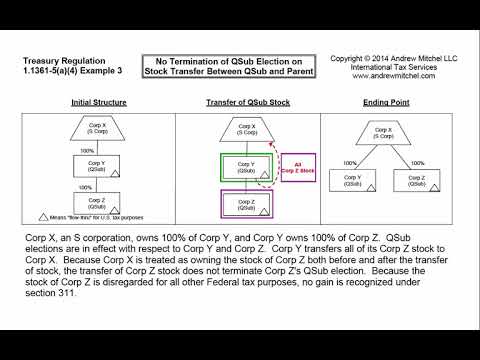

Music in example 3 of regulation 1.13 61 - 5a for an S corporation owned a Q sub, which in turn owned another Q sub, acute sub is a corporation wholly owned by an S corporation that makes an election to be treated as a Q. So, Q sub is not treated as a separate corporation, and all of its assets, liabilities, income, and deductions are attributed directly to the S corporation. In this example, Corp y ik u sub transferred all of the stock of Corp z ik u sub to Corp X, the S corporation. Because Corp X is treated as owning the stock of Corp Z both before and after the transfer, the transfer does not terminate Corp Z's Q sub election. Also, because Corp Y and Corpsey are disregarded for all other federal tax purposes, no gain is recognized under Section 311.

Award-winning PDF software

Termination of qsub election Form: What You Should Know

Section 463(e)(1)(A) of the Internal Revenue Code provides that an S corporation can revoke a Sub election only when, at the time a change is made in the status of the parent (if any), or the status of the subsidiary (or its successor), under section 7526(l), it informs the appropriate tax authorities. An S corporation may issue a revocation for any change that is made within 6 months after the last date on which the subsidiary was treated as a Sub. 25% Notice — Sub Election. (3) The notice under section 463(d) must also indicate that the notice of revocation will remain in effect only in the event of a revocation under section 1361. 27.3.6.1.17 (05-24-2018) Qualified Subsidiaries — A subsidiary is qualified if it is one of the following. It is incorporated with a certificate of good standing, in addition to the certificate issued to the parent S corporation, and has no outstanding claims against the S corporation and no outstanding tax. It has a liquidation election not to be treated as a Sub unless one is in effect. The election is revoked or is terminated within 180 days of the date of revocation or termination, whichever is later. It has a liquidation election not to be treated as a Sub unless one is in effect. The election is revoked or is terminated within 45 days of the date of revocation or termination, whichever is later. It does not have outstanding claims against the S corporation. A subsidiary is not qualified if it has an election to be treated as a Sub, is a real estate holding company, or is an S corporation without shareholders. A subsidiary must satisfy all two of three criteria in order to be qualified. An S corporation does not make a determination whether a subsidiary is qualified for the purpose of applying the liquidation election. An S corporation can treat a subsidiary as a qualified Sub when the subsidiary has entered into: (A) A stock dividend election, or (B) A liquidation election. 26 CFR § 1.1361-3 — Sub election. — Law. Cornell. EDU The notice must state the name of the subsidiary at the time it is converted into an S corporation, if the predecessor subsidiary was not a taxable subsidiary.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8869, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8869 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8869 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8869 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Termination of qsub election