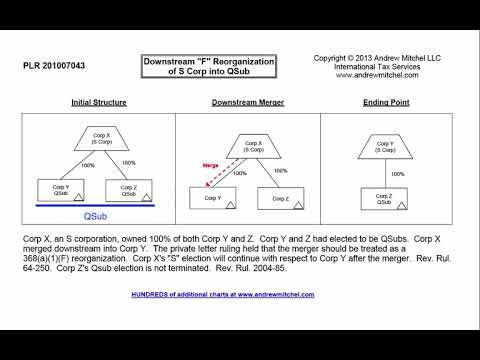

Music in PLR 2010. Oh 7o 43 corvex, an S-corporation, on 100% of both Corp Y & Z. As an aside, I thought I would just mention that the first four numbers in a private letter ruling are the year that the ruling was published, the next two numbers are the week of publication, and the last three numbers are just sequential numbers assigned by the IRS for determinations published for that week. Back to the private letter ruling, Corp Y and quark Z had elected to BQ subs of court X. IKU sub is a corporation wholly owned by an S corporation that has made an election to be treated as a Q sub. The Q sub is not treated as a separate corporation; instead, all of its assets, liabilities, income, and deductions are attributed directly to the S corporation that owns the Q sub, corvex. The S corporation merged downstream into Corp Y, one of the Q subs. Corp I survived the merger, and Corp X was merged out of existence. The private letter ruling held that the merger should be treated as an F reorganization under Section 368. Corp X's S election will continue with respect to quark Y after the merger, and Court ZZZ Q sub election continues as well. Music.

Award-winning PDF software

Rev rul 2020-85 Form: What You Should Know

Internal Revenue Bulletin: 2020-06 Mar 15, 2025 — NOTICE 2020-86, page 1646. This notice sets forth the updated Mortality tables that are used for purposes Internal Revenue Bulletin: 2020-09 Feb 24, 2025 — SUMMARY: This document sets forth the updated U.S. return of partnership income, see IRB Notice (RA). Guidance Under section 6323 regarding the reporting of nonresident aliens Oct 15, 2025 — Notice of Exempt Organizations. EO: 2016-24, Notice of Exempt Organizations. Internal Revenue Bulletin: 2020-05 May 22, 2025 — Notice of Exempt Organizations EO: 2017-11. May 21, 2025 — Notice of Exempt Organizations EO: 2017-8. Internal Revenue Bulletin: 2020-04 Dec 20, 2025 — NOTICE 2018-2-16, page 1061. This notice addresses the tax exemption of certain nonprofit organizations with domestic nonprofit status, and how to identify the organizations for reporting purposes. Internal Revenue Bulletin: 2020-51 Mar 17, 2025 — SUMMARY: This document sets forth revised mortality tables that are used for purposes. Internal Revenue Bulletin: 2020-09 Feb 24, 2025 — Notice of Exempt Organizations EO: 2017-28-0. Feb 24, 2025 — Notice of Exempt Organizations EO: 2017-9. Internal Revenue Bulletin: 2020-05 May 22, 2025 — Notice of Exempt Organizations EO: 2017-32-8. Internal Revenue Bulletin: 2020-04 Dec 20, 2025 — Notice of Exempt Organizations EO: 2018-1; and Notice of Exempt Organizations EO: 2018-2. Internal Revenue Bulletin: 2020-05 Jun 20, 2025 — This Notice discusses the special valuation rules for employers and employees, and how to use such rules in determining the IRS 2025 Rulings from IRB. Internal Revenue Bulletin: 2020-06 Aug 22, 2025 — Notice of Exempt Organizations EO: 2018-13. Internal Revenue Bulletin: 2020-05 Sep 30, 2025 — This Notice addresses the special valuation rules for employers and employees, and how to use such rules in determining the IRS 2025 Rulings from IRB.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8869, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8869 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8869 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8869 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rev rul 2020-85