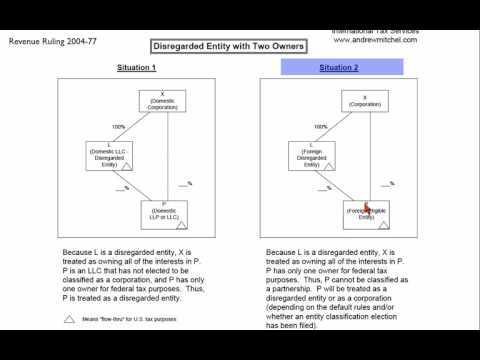

Normally, if a US LLC is not elected to be taxed as a corporation and it has more than one owner, the LLC defaults to be taxed as a partnership for US tax purposes. However, in Revenue Ruling 2004-77, situation 1p was a US LLC with multiple owners that was treated as a disregarded entity for US tax purposes. The special aspect of the structure in the ruling is that one of the owners, a dl, was itself a disregarded entity of the other owner of P. Since entity L was disregarded, the other owner of P was treated as owning both interests, or 100% of P. Thus, P was treated as a disregarded entity even though it legally had more than one owner. Situation two of the ruling deals with similar facts, except that entity L and entity P are foreign entities, with entity L having elected to be taxed as a disregarded entity. The ruling concludes that P is treated as only having one owner and should not be taxed as a partnership for US purposes. P's entity classification will be either a disregarded entity or a corporation, depending on the entity classification default rules and whether an entity classification election has been made. It is important to note that the entity classification default rules for foreign entities are not the same as those for domestic entities.

Award-winning PDF software

Rev rul 73 18 Form: What You Should Know

Of a Subsidiary to a Related Foreign F Corp.” This form has a section for each foreign bank in which each subsidiary, its interest in which was disposed of, or its income from which was subject to tax, is reported. The first line of the following table in Rev. Run. 73-605 is substituted for the current definition: (a) Amount of payment received from a foreign F Corp.; (b) Amount of payment received by a foreign F Corp. and paid into a foreign bank; (c) The foreign FAR payment; and (d) The foreign FAR payment and the amount of foreign FAR payment that represents the “average amount” of the payment received by the foreign F Corp. and the foreign FAR payment. (a) Amount of payment received from a foreign F Corp.; (b) Amount of payment received by a foreign F Corp. and paid into a foreign bank; (c) The foreign FAR payment; and (d) The foreign FAR payment and the amount of foreign FAR payment that represents the “average amount” of the payment received by the foreign F Corp. and the foreign FAR payment; (2) the requirement that the foreign tax on taxable foreign wages paid to U.S. holders be included In Rev. Run. 73-605, each subsidiary whose hypothetical tax computed on a separate return basis exceeded its allocable share of the consolidated tax should submit two separate Forms 8862 and 8863, “Foreign Tax Identification Number for Payment of Wages, Salaries, and Other Compensation in Connection with the Disposition by the Related Foreign F Corp. of a Subsidiary to a Related Foreign F Corp.” The form has a section for each foreign bank in the United States that provides, among other things, the name, address, and FAR number of the bank and the FAR number of the individual who makes, signs, or receives the payment. The first line of the following table in Rev. Run. 73-605 is substituted: (a) Amount of payment received by a foreign F Corp. or a foreign F Corp. that has a total foreign income not related to wages, salary, business transactions and similar income, and that is reported on the appropriate Form F 2081.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8869, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8869 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8869 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8869 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rev rul 73 18