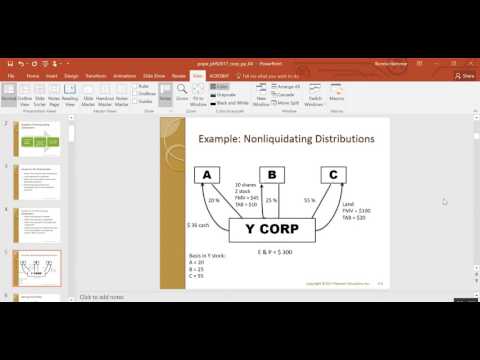

Hi everyone, we've moved into Chapter four now, which covers corporate nonliquidating distributions. I thought it would be helpful to walk you through a few of these PowerPoint slides on the chapter, which, as a reminder, are available to you guys as well. If you go into tools and then the multimedia library in myaccountinglab, you'll find a PowerPoint presentation of slides and sometimes other items in the library for each chapter. Just remember that those are available to you as well. So first of all, when we're making a distribution, a nonliquidating distribution, we need to understand the earnings or profits of the corporation. The reason we need to know that is because under Section 316 in the code, any distributions coming out of, to the extent of, current earnings and profits (EMP) or accumulated EMP are deemed to be considered dividends. Section 301 of the code tells us that dividends are taxable to shareholders. Let's say that the corporation has accumulated EMP of negative $50. This means it has an accumulated EMP deficit as of the beginning of the year of $50. However, it has current EMP earnings during the year of $10. If it makes a distribution of cash to its sole shareholder of $5, you first look at current EMP and then accumulated EMP. In this case, because there's a current EMP of $10 and the distribution is only $5, the entire distribution of $5 in cash would be deemed a dividend to the shareholder. However, if the distribution was $15 and we only have $10 in current EMP and no accumulated EMP (due to the $50 deficit at the beginning of the year), only $10 of the $15 distribution would be considered a dividend. That's because $10 is the current EMP balance at the end of the year...

Award-winning PDF software

F reorganization checklist Form: What You Should Know

Rev. Run. 2008-18: Sec. 4.2(e)-(f) Rev. Run. 2008-18: Sec. 401(a) Plan Amendments-Reclassification. . . 4.2(e)-(f) The Plan Amendment(s) may not affect the benefits or privileges of the Plan, Sub-Table for the Rev. Run. 2008-18: Sec. 401(a) Plan Amendments-Reclassification 4.2(e)-(f). FREEMAN'S CUSTOMER CORE: Sub-Classification. Section 401(k) (Rev. Run. 2008-18: section 401(k)(2)(D)). . . . 5. Sub-Section, (k) — Subchapter D; Change of Name. . . 5. Sub-Section, (k) — Entitlement of Trustee. . . 5. Sub-Section, (k) — Change in Actuarial Value of Trustee Stock. . . 5. Excluded Sub-Section, (k) — Plan Contribution and Plan Termination. There must not be a material disruption in the relationship between (a) the Plan Sponsor, (b) the Employee, (c) the Plan Service, and [NAME OF SUBSEQUENT PARTNER], and the Trustee. 5. Rev. Run. 2008-18: Sec. 401(k)(2)(J). FREEMAN'S FOREIGN CUSTOMER CORE: Section 401(k) [Rev. Run. 2008-18: section 401(k)(2)(J)]. . . . 6. Section 401(k) [Rev. Run. 2008-18: section 401(k)(2)(J)]. . . . FREEMAN'S FOREIGN CUSTOMER CORE: Sec. 401(k) [Rev. Run. 2008-18: section 401(k)(2)(J)]. . . . . Excel and other word processing programs: Excel has a handy function for creating tables of data, so we're not limited to simple text. FREEMAN'S EMPLOYEE CORE: Section 401(k) [Rev. Run.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8869, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8869 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8869 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8869 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing F reorganization checklist